As we get into 2025, savvy investors may have already started contributing to their Roth IRA for the year. Does pro rata rule apply to backdoor Roth IRA? What’s the contribution process like on Fidelity? Let’s find out.

What is Backdoor Roth IRA?

IRS enforces a limit on modified adjusted gross income (MAGI) to be eligible for Roth IRA contribution. Backdoor Roth IRA is a strategy by high-income earners to make contributions, by converting their traditional IRA to a Roth IRA.

For 2025, single filers must have a modified adjusted gross income (MAGI) of less than $150,000, and joint filers less than $236,000, to make a full contribution. It completely phases out for single filers that have MAGI greater than $165,000 and joint filers greater than $246,000.1 If your income is greater than that, you can leverage backdoor Roth IRA for contribution.

Does pro rata rule apply to backdoor Roth IRA?

The Pro-Rata rule applies if your traditional IRA contains both pre-tax and after-tax contributions. So If the traditional IRA only contains after-tax money, the pro rata rule does not apply. Therefore, if you do not have the intention of converting your pre-tax money, you should have a traditional IRA account just for backdoor Roth purpose, and keep the account balance $0 (other than the time you’re doing a backdoor contribution).

Step by step guide for contributing on Fidelity

Here I’m using Fidelity to illustrate, because that’s the accounts I use. Other accounts, like Vanguard and Schwab should work similar.

Step 1: Open a traditional IRA account (If you don’t have one)

Go to https://www.fidelity.com/retirement-ira/traditional-ira, and click on Open a traditional IRA. Follow the instructions to open the account.

Step 2: Contribute to traditional IRA

Contributing to the traditional IRA is same as accounts transfers. After logging in, select Transfer. In the dropdown, select EFT to or from a bank if you are funding from an external bank account; select Transfer cash or shares between Fidelity accounts if you are funding from your other fidelity account.

Transfer between Fidelity accounts is fast, usually within a few minutes. Transfer from external accounts can take a few business days. You can check the Cash Balance in your IRA account to see if the transfer is complete.

Step 3: Rollover to Roth IRA

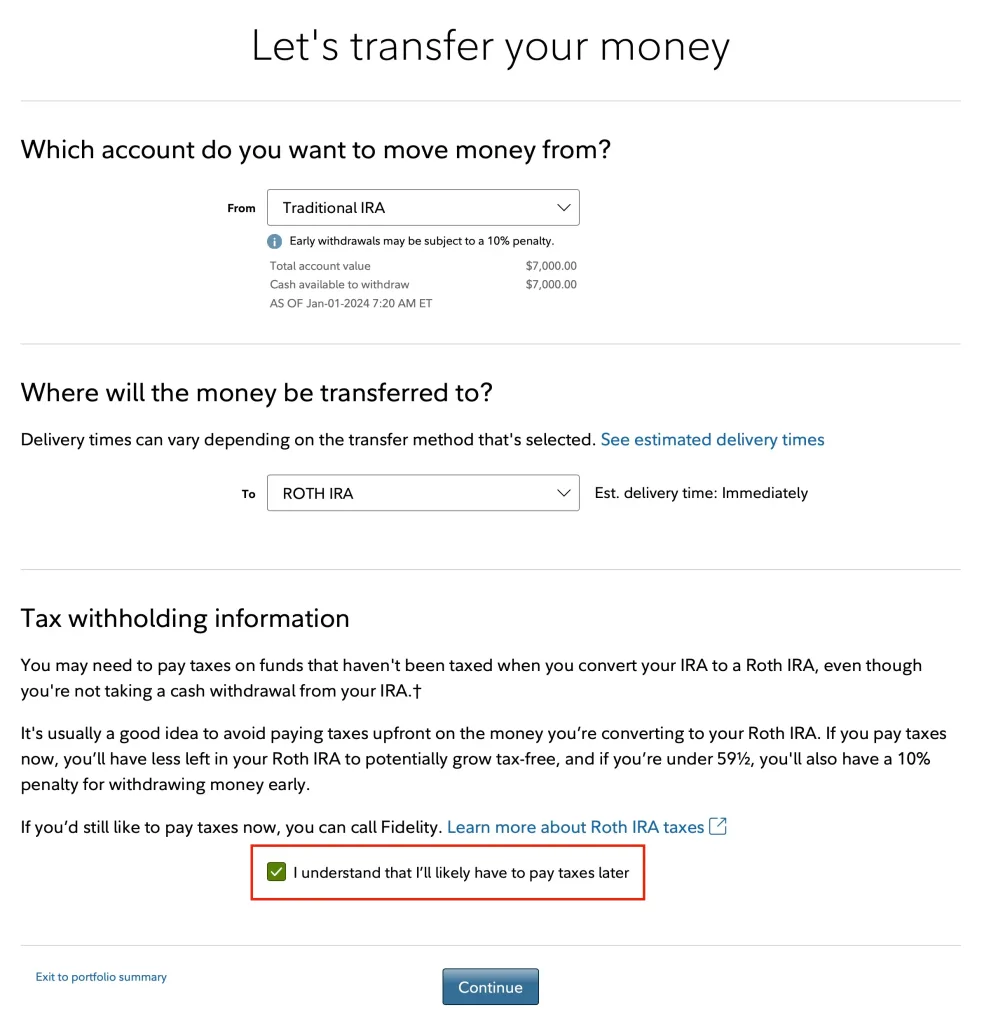

Rollover traditional IRA to Roth IRA is done as another “transfer between accounts”. Navigate to the Transfer option located at the top of the Fidelity page. Select Transfer cash or shares between Fidelity accounts to initiate a Roth Conversion by moving funds from your Traditional IRA to your Roth IRA.

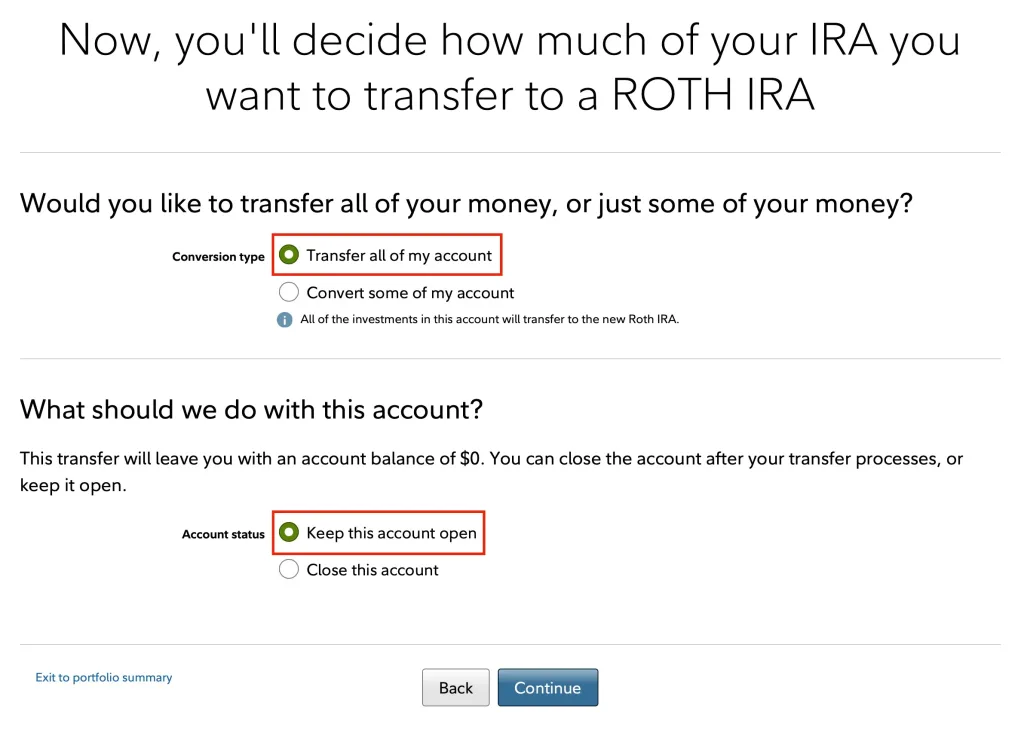

Each year, convert the full balance from the Traditional IRA to the Roth IRA, ensuring the Traditional IRA remains at a $0 balance for the rest of the year, except during the brief 1-3 days required to complete the Roth conversion. Keep the Traditional IRA account open to facilitate future backdoor Roth contributions.

Step 4: Invest your fund

Once the fund is settled in Roth IRA accounts, you can start investing. Fidelity IRA account offers a rich investing options to choose from: stocks, ETFs, bonds and mutual funds. Check out investing-101 on some ideas for investing; also my previous post on what funds may be more suitable for a Roth account.

Most importantly, stay the course and cheers!

Tax return for backdoor Roth IRA

During tax season, you’ll need to do some additional work for backdoor IRA and I’ll write another step-by-step guide during tax return. Stay tuned.